Auto Insurance in and around Atlanta

Auto owners of Atlanta, State Farm has you covered

Put it into drive, wisely

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Everyone knows that State Farm has great auto insurance. From sedans to smart cars pickup trucks to SUVs, we offer a wide variety of coverages.

Auto owners of Atlanta, State Farm has you covered

Put it into drive, wisely

Auto Coverage Options To Fit Your Needs

The right savings may look different for everyone, but the provider can be the same. From emergency road service coverage and liability coverage to savings like the good driver discount and Steer Clear®, State Farm really shifts these options into gear.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever mishaps occur to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

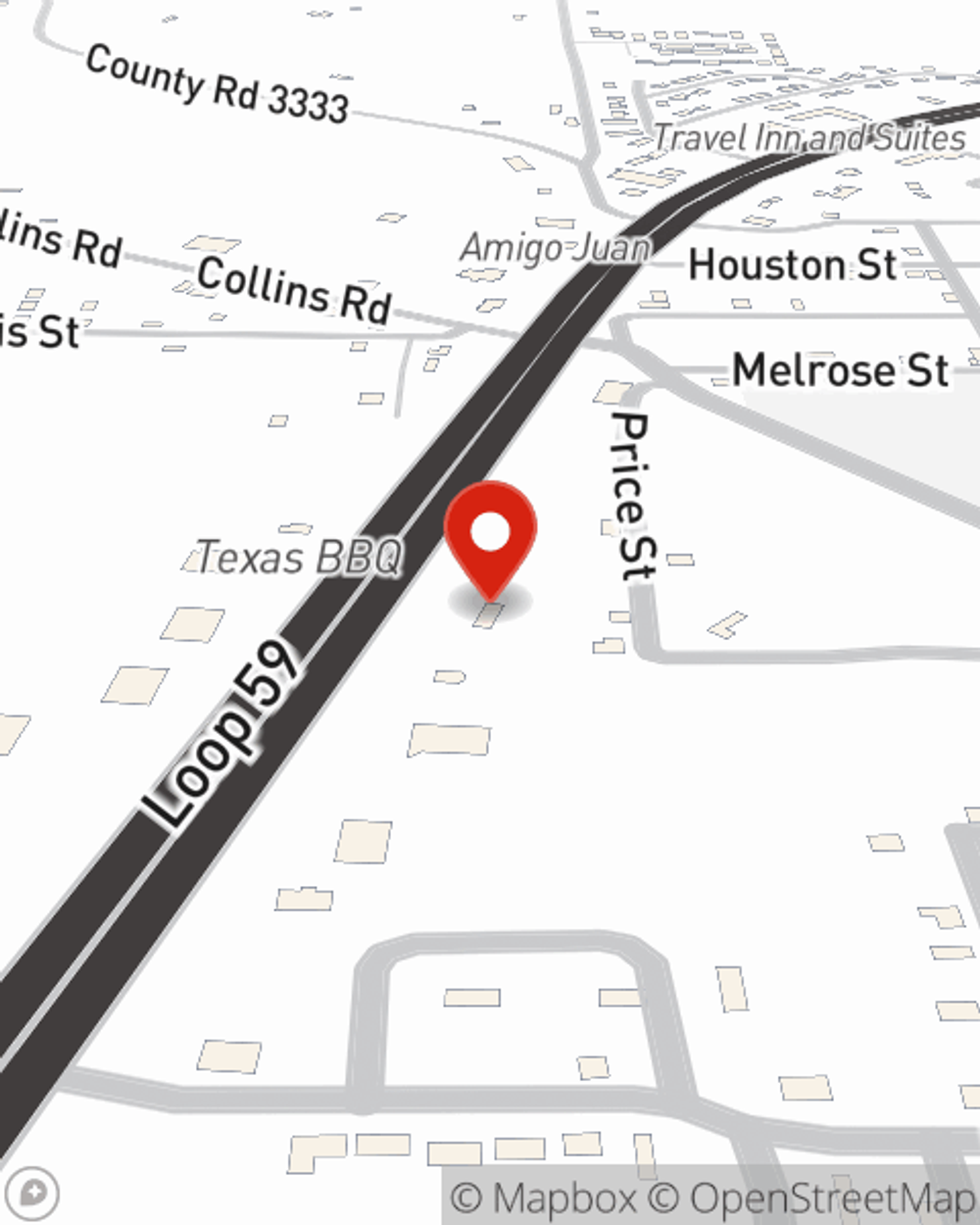

Call Kelli at (903) 796-8100 or visit our FAQ page.

Simple Insights®

Tips to deal with most common home emergencies

Tips to deal with most common home emergencies

Do you have an effective emergency management plan? Here are step-by-step instructions to deal with common home emergencies.

Understanding your car rental reimbursement coverage: what to know

Understanding your car rental reimbursement coverage: what to know

Understand your auto policy and how rental reimbursement coverage could be a beneficial addition to your insurance plan.

Kelli Ashbrook-Cummings

State Farm® Insurance AgentSimple Insights®

Tips to deal with most common home emergencies

Tips to deal with most common home emergencies

Do you have an effective emergency management plan? Here are step-by-step instructions to deal with common home emergencies.

Understanding your car rental reimbursement coverage: what to know

Understanding your car rental reimbursement coverage: what to know

Understand your auto policy and how rental reimbursement coverage could be a beneficial addition to your insurance plan.